题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Which part of the country was hit by the windstorm ?A.SoutheastB.NorthwestC.Southwest

Which part of the country was hit by the windstorm ?

A.Southeast

B.Northwest

C.Southwest

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Which part of the country was hit by the windstorm ?

A.Southeast

B.Northwest

C.Southwest

更多“Which part of the country was …”相关的问题

更多“Which part of the country was …”相关的问题

A、Made a bonus issue of shares.

B、Revalued its property, plant and equipment upwards.

C、Paid a dividend to its shareholders.

D、Repaid part of a long-term bank loan.

Which of the following is NOT true about the House of Commons in Britain?

A.The House of Commons is the most powerful part of Parliament.

B.General elections for the House of Commons are held at least every 6 years.

C.The ultimate authority for law-making is in the House of Commons.

D.The House of Commons consists of 651 members of Parliament.

A、A. (1) and (2)

B、B. (1) and (4)

C、C. (2) and (3)

D、D. (3) and (4)

KLE Co The following scenario relates to questions 16 – 20. You are an audit manager in the internal audit department of KLE Co, a listed retail company. The internal audit department is auditing the company's procurement system. KLE’s ordering department consists of six members of staff: one chief buyer and five purchasing clerks. All orders are raised on pre-numbered purchase requisition forms, and are sent to the ordering department. In the ordering department, each requisition form is approved and signed by the chief buyer. A purchasing clerk transfers the order information onto an order form and identifies the appropriate supplier for the goods. Part one of the two part order form is sent to the supplier and part two to the accounts department. The requisition is thrown away. Which of the following is NOT a likely effect of the deficiencies in the internal control system described?

A、Purchases may be made unnecessarily at unauthorised prices

B、Subsequent queries on orders cannot be traced back to the original requisition

C、The order forms may contain errors that are not identified

D、Goods could be ordered twice in error or deliberately

Required:

(a) Identify and explain TWO factors which would indicate that an engagement letter for an existing audit client should be revised. (2 marks)

(b) List SIX matters which should be included within an audit engagement letter. (3 marks)

(c) Your audit firm has just won a new audit client, Milky Way Technologies Co (Milky Way), and you have been asked by the audit engagement partner to gain an understanding about the new client as part of the planning process.

Required:

Identify FIVE sources of information relevant to gaining an understanding of Milky Way Technologies Co and describe how this information will be used by the auditor. (5 marks)

As part of Tye Co’s service contract with the government, it is required to hold an emergency inventory reserve of 6,000 barrels of aviation fuel. The inventory is to be used if the supply of aviation fuel is interrupted due to unforeseen events such as natural disaster or terrorist activity.

This fuel has in the past been valued at its cost price of $15 a barrel. The current value of aviation fuel is $120 a barrel. Although the audit work is complete, as noted above, the directors of Tye Co have now decided to show the ‘real’ value of this closing inventory in the financial statements by valuing closing inventory of fuel at market value, which does not comply with relevant accounting standards. The draft financial statements of Tye Co currently show a profit of approximately $500,000 with net assets of $170 million.

Required:

(a) List the audit procedures and actions that you should now take in respect of the above matter. (6 marks)

(b) For the purposes of this section assume from part (a) that the directors have agreed to value inventory at

$15/barrel.

Having investigated the matter in part (a) above, the directors present you with an amended set of financial

statements showing the emergency reserve stated not at 6,000 barrels, but reported as 60,000 barrels. The final financial statements now show a profit following the inclusion of another 54,000 barrels of oil in inventory. When queried about the change from 6,000 to 60,000 barrels of inventory, the finance director stated that this change was made to meet expected amendments to emergency reserve requirements to be published in about six months time. The inventory will be purchased this year, and no liability will be shown in the financial statements for this future purchase. The finance director also pointed out that part of Tye Co’s contract with the government requires Tye Co to disclose an annual profit and that a review of bank loans is due in three months. Finally the finance director stated that if your audit firm qualifies the financial statements in respect of the increase in inventory, they will not be recommended for re-appointment at the annual general meeting. The finance director refuses to amend the financial statements to remove this ‘fictitious’ inventory.

Required:

(i) State the external auditor’s responsibilities regarding the detection of fraud; (4 marks)

(ii) Discuss to which groups the auditors of Tye Co could report the ‘fictitious’ aviation fuel inventory;

(6 marks)

(iii) Discuss the safeguards that the auditors of Tye Co can use in an attempt to overcome the intimidation

threat from the directors of Tye Co. (4 marks)

Section B – TWO questions ONLY to be attempted

(a) You are an audit manager in Weller & Co, an audit firm which operates as part of an international network of firms. This morning you received a note from a partner regarding a potential new audit client:

‘I have been approached by the audit committee of the Plant Group, which operates in the mobile telecommunications sector. Our firm has been invited to tender for the audit of the individual and group financial statements for the year ending 31 March 2013, and I would like your help in preparing the tender document. This would be a major new client for our firm’s telecoms audit department.

The Plant Group comprises a parent company and six subsidiaries, one of which is located overseas. The audit committee is looking for a cost effective audit, and hopes that the strength of the Plant Group’s governance and internal control mean that the audit can be conducted quickly, with a proposed deadline of 31 May 2013. The Plant Group has expanded rapidly in the last few years and significant finance was raised in July 2012 through a stock exchange listing.’

Required:

Identify and explain the specific matters to be included in the tender document for the audit of the Plant Group. (8 marks)

(b) Weller & Co is facing competition from other audit firms, and the partners have been considering how the firm’s revenue could be increased. Two suggestions have been made: 1. Audit partners and managers can be encouraged to sell non-audit services to audit clients by including in their remuneration package a bonus for successful sales. 2. All audit managers should suggest to their audit clients that as well as providing the external audit service, Weller & Co can provide the internal audit service as part of an ‘extended audit’ service. Required: Comment on the ethical and professional issues raised by the suggestions to increase the firm’s revenue. (8 marks)

Chair Co plans on pricing the seat by adding a 50% mark-up to the total variable cost per seat, with the labour cost being based on the incremental time taken to produce the 8th unit.

Required:

(a) Calculate the price which Chair Co expects to charge for the new seat. Note: The learning index for a 75% learning curve is –0·415. (5 marks)

(b) The first phase of production has now been completed for the new car seat. The first unit actually took 12·5 hours to make and the total time for the first eight units was 34·3 hours, at which point the learning effect came to an end. Chair Co are planning on adjusting the price to reflect the actual time it took to complete the 8th unit.

Required:

(i) Calculate the actual rate of learning and state whether this means that the labour force actually learnt more quickly or less quickly than expected. (3 marks)

(ii) Briefly explain whether the adjusted price charged by Chair Co will be higher or lower than the price you calculated in part (a) above. You are NOT required to calculate the adjusted price. (2 marks)

(a) You are a manager in Lapwing & Co. One of your audit clients is Hawk Co which operates commercial real estate properties typically comprising several floors of retail units and leisure facilities such as cinemas and health clubs, which are rented out to provide rental income.

Your firm has just been approached to provide an additional engagement for Hawk Co, to review and provide a report on the company’s business plan, including forecast financial statements for the 12-month period to 31 May 2013. Hawk Co is in the process of negotiating a new bank loan of $30 million and the report on the business plan is at the request of the bank. It is anticipated that the loan would be advanced in August 2012 and would carry an interest rate of 4%. The report would be provided by your firm’s business advisory department and a second partner review will be conducted which will reduce any threat to objectivity to an acceptable level.

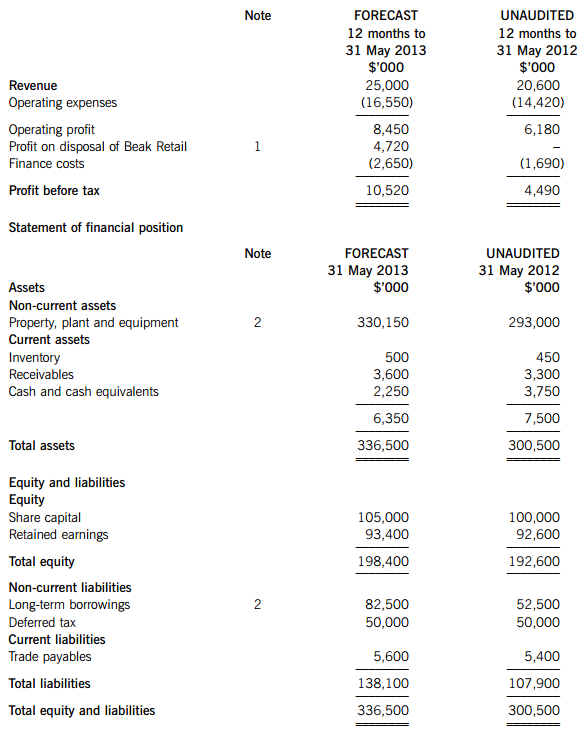

Extracts from the forecast financial statements included in the business plan are given below:

Statement of comprehensive income (extract)

Notes:

1. Beak Retail is a retail park which is underperforming. Its sale is currently being negotiated, and is expected to take place in September 2012.

2. Hawk Co is planning to invest the cash raised from the bank loan in a new retail and leisure park which is being developed jointly with another company, Kestrel Co.

Required:

In respect of the engagement to provide a report on Hawk Co’s business plan:

(i) Identify and explain the matters that should be considered in agreeing the terms of the engagement; and Note: You are NOT required to consider ethical threats to objectivity. (6 marks)

(ii) Recommend the procedures that should be performed in order to examine and report on the forecast financial statements of Hawk Co for the year to 31 May 2013. (13 marks)

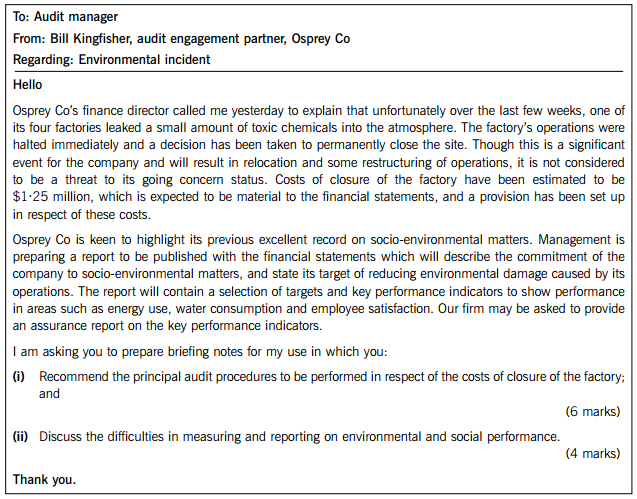

(b) You are also responsible for the audit of Osprey Co, which has a financial year ended 31 May 2012. The audit engagement partner, Bill Kingfisher, sent you the following email this morning:

Required:

Respond to the partner’s email. (10 marks)

Note: the split of the mark allocation is shown within the partner’s email.

Professional marks will be awarded in part (b) for the presentation and clarity of your answer. (4 marks)

Section B – TWO questions ONLY to be attempted

You are a manager in the assurance department at Raphael & Co, a firm of Chartered Certified Accountants. Your firm has been appointed by Sanzio Co to perform. a due diligence review of a potential acquisition target, Titian Tyres Co. As part of the due diligence review and to allow for consideration of an appropriate offer price, Sanzio Co has requested that you identify and value all the assets and liabilities of Titian Tyres Co, including items which may not currently be reported in the statement of financial position.

Sanzio Co is a large, privately owned company operating only in this country, which sells spare parts and accessories for cars, vans and bicycles. Titian Tyres Co is a national chain of vehicle service centres, specialising in the repair and replacement of tyres, although the company also offers a complete range of engine and bodywork services as well. If the acquisition is successful, the management of Sanzio Co intends to open a Titian Tyres service centre in each of its stores.

One of the reasons for Titian Tyres Co’s success is their internally generated customer database, which records all customer service details. Using the information contained on the database software, the company’s operating system automatically informs previous customers when their vehicle is due for its next service via email, mobile phone text or automated letter. It also informs a customer service team to telephone the customer if they fail to book a service within two weeks of receiving the notification. According to the management of Titian Tyres Co, repeat business makes up over 60% of annual sales and management believes that this is a distinct competitive advantage over other service centres.

Titian Tyres Co also recently purchased a licence to distribute a new, innovative tyre which was designed and patented in the United States. The tyre is made of 100% recycled materials and, due to a new manufacturing process, is more hardwearing and therefore needs replacing less often. Titian Tyres Co paid $5 million for the licence in January 2015 and the company is currently the sole, licenced distributor in this country.

During a brief review of Titian Tyres Co’s financial statements for the year ended 30 June 2015, you notice a contingent liability disclosure in the notes relating to compensation claims made after the fitting of faulty engine parts during 2014. The management of Titian Tyres Co has stated that the fault lies with the manufacturer of the part and that they have made a claim against the manufacturer for the total amount sought by the affected customers.

Required:

(a) Describe the purpose of a due diligence assignment and compare the scope of a due diligence assignment with that of an audit of historical financial statements. (6 marks)

(b) (i) Recommend, with reasons, the principal additional information which should be made available to assist with your valuation of Titian Tyres Co’s intangible assets.

(ii) Explain the specific enquiries you should make of Titian Tyres Co’s management relevant to the contingent liability disclosed in the financial statements.

Note: The total marks will be split equally between each part. (14 marks)

‘I was alerted yesterday to a fraud being conducted by members of our sales team. It appears that several sales representatives have been claiming reimbursement for fictitious travel and client entertaining expenses and inflating actual expenses incurred. Specifically, it has been alleged that the sales representatives have claimed on expenses for items such as gifts for clients and office supplies which were never actually purchased, claimed for business-class airline tickets but in reality had purchased economy tickets, claimed for non-existent business mileage and used the company credit card to purchase items for personal use.

I am very worried about the scale of this fraud, as travel and client entertainment is one of our biggest expenses. All of the alleged fraudsters have been suspended pending an investigation, which I would like your firm to conduct. We will prosecute these employees to attempt to recoup our losses if evidence shows that a fraud has indeed occurred, so your firm would need to provide an expert witness in the event of a court case. Can we meet tomorrow to discuss this potential assignment?’

Chestnut Co has a small internal audit department and in previous years the evidence obtained by Cedar & Co as part of the external audit has indicated that the control environment of the company is generally good. The audit opinion on the financial statements for the year ended 31 March 2011 was unmodified.

Required:

(a) Assess the ethical and professional issues raised by the request for your firm to investigate the alleged fraudulent activity. (6 marks)

(b) Explain the matters that should be discussed in the meeting with Jack Privet in respect of planning the investigation into the alleged fraudulent activity. (6 marks)

(c) Evaluate the arguments for and against the prohibition of auditors providing non-audit services to audit clients. (6 marks)

为了保护您的账号安全,请在“简答题”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

简答题

简答题

微信搜一搜

微信搜一搜

简答题

简答题